Accounting Period Close Process

This section includes the following topics:

- Overview

- Preparing Projector Production Data

- Transmitting Job Accounting Data

- Managing Accounting System Data

See the chapter on Accounting Integration for additional topics.

Overview

Projector can act as a multi-company, multi-currency job accounting sub ledger for an accounting system. As such, Projector needs to play a role in the accounting period close workflow to ensure information is posted to the general ledger in a timely and accurate fashion.

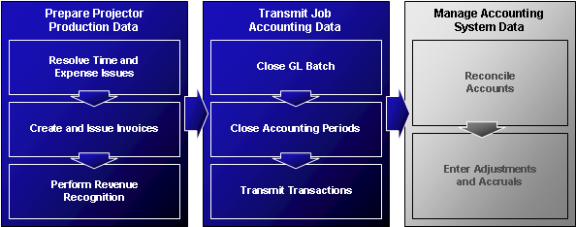

The overall process consists of three major stages:

- Preparing production data in Projector, which entails ensuring (as much as possible) that time and expense entry and approvals are complete, invoices are reviewed and issued, and revenue is properly recognized.

- Transmitting job accounting data from Projector to the accounting system, which encompasses managing transaction batches and accounting periods and ensuring transactions are successfully pushed to the accounting system.

- Managing accounting system data in the accounting system, which entails performing any account reconciliation necessary, posting any adjustments required, and posting accruals as necessary.

This workflow can be summarized as follows:

Preparing Projector Production Data

Many of the steps in the preparing Projector production data stage probably occur in the organization on a regular basis independent of the period close process, but it is especially critical that this data is accurate before closing. The three steps presented below should generally be performed in order for individual engagements, but each step does not need to be completed in its entirety prior to beginning subsequent steps.

Resolving Time and Expense Issues

The first step in the closing process is to make sure time and expense data is as accurate and complete as possible. From the perspective of time, Projector's Time Browser is the most useful tool to identify resources that have "problem" time---i.e., missing, draft, rejected, and unapproved time. Any hours in these categories may represent revenue that can be recognized or billed to a client during the period that is about to be closed, so pushing to resolve this problem time before closing helps promote earlier realization of revenue and collection of cash from clients.

Similarly, expense reports that have not yet been submitted or approved to pay need to be resolved to ensure timely posting and billing of expenses. Projector's Expense Report Browser is the most useful tool to assist with expense reports that have been rejected and need to be corrected and re-submitted, and those that have been submitted by not yet fully approved.

Creating and Issuing Invoices

Once time and expenses are as accurate and up-to-date as possible, invoices can be created, the time and cost cards can be adjusted as necessary, and the invoices can be issued. Issuing invoices as early as possible ensures the Time and Cost WIP accounts are updated and WIP is converted into AR as early as possible. The Invoice Browser and Invoice Editor screens are the principal tools used to create and issue invoices, and the Project Dashboard and Unbilled Time and Cost Aging report can be used to understand what unbilled WIP remains.

Performing Revenue Recognition

Properly recognizing revenue on fixed price and not to exceed engagements is the final step in the first stage and should be completed before job accounting data is transmitted into the accounting system. This process ensures that the proper amount of revenue to date, based on the engagement's contract terms and contract value and how much of the engagement is complete, is recognized in accordance with GAAP guidelines. Because Projector's revenue recognition algorithms rely on measuring actuals to date (entered time cards) and estimate to complete (scheduling data) to calculate percent complete and allocate out adjustments, that data should be as accurate as possible before performing revenue recognition. Specifically, users should resolve "problem" time (as described above), verify that contract rates are accurate, ensure forward-looking booked hours are up to date, and verify contract terms and contract values for accuracy.

Transmitting Job Accounting Data

This section includes information on Closing the GL Transaction Batch, Closing Accounting Periods, and Transmit Transactions.

Closing the GL Transaction Batch

Once all the actions that create accounting transactions have been completed, the current open GL transaction batch can be closed. As described previously, this aggregates all the queued up GL transactions into a set of summary transactions, one for each company and accounting period, and queues up the summary transaction for transmission to the accounting system.

Closing Accounting Periods

After the GL transaction batch is closed, the current accounting period can be closed for AP, AR, and/or GL transactions to ensure no additional transactions hit that accounting period. Users may wish to close older accounting periods for time and cost entry at this point as well to prevent a resource from entering costs for very old time periods. For instance, during the process of performing the close process for the month of April, organizations may wish at this point to close the April accounting period for AP, AR, and GL transactions, and also close out the February (and earlier) accounting periods for time and cost entry.

Transmit Transactions

Finally, users should transmit AP, AR, and GL transactions through the period being closed to the accounting system, either using Projector's automated accounting interface or by re-keying in transactions from Projector's Accounting Period Transactions report. The automated accounting interface will change the status of transactions that have been successfully transmitted to Confirmed. If transactions are being re-keyed into the accounting system, users will need to change the status of transactions to Transmitted or Confirmed manually. Whichever mechanism is being used to send data into the accounting system, users should ensure that all the transactions through the period to be closed have been successfully transmitted before moving on to the next stage. Any transactions left in the failed (which means the accounting system received but rejected the transaction) or transmitted (which means the accounting system never positively confirmed receipt of the transaction) states should be investigated.

Managing Accounting System Data

Reconciling Accounts

Once transactions have been successfully transmitted to the accounting system, users may wish to reconcile certain accounts to ensure that Projector and the accounting system agree on what the balances should be. Projector's view of balances in the balance sheet control accounts should tie out exactly to the accounting system's view of the balances since no other transactions should be hitting these accounts. To reconcile P&L or balance sheet accounts that are not considered control accounts, Projector's reports will be able to provide information about all of Projector transactions that hit those accounts, but won't explain the balances themselves since non-Projector transactions likely have hit those accounts.

Information to reconcile these accounts can be accessed through Projector's Accounting Balances and Accounting Analysis reports, both of which can be accessed from the Reports tab. The Accounting Balances report shows the net balances as of the end of an accounting period for Projector control accounts. The Accounting Analysis Report lists all the AR, AP, and GL transactions, along with more detail than was actually pushed to the accounting system, to justify Projector's impact on both balance sheet and P&L accounts.

Entering Adjustments and Accruals

Based on information in the accounting reports, financial managers may want to enter adjustments or accruals directly into the GL for several reasons to account for issues such as WIP aging. Projector's Unbilled Time and Cost Aging Report breaks down the value of the time and cost cards in WIP by the age of the WIP. Based on historical performance, financial managers may want to take a reserve based on a percentage of the value of WIP in each aging category.

There may be other adjustments and accruals that may need to be made to the accounting system based on Projector information. To understand what other information can be extracted from Projector using its analytical reporting capabilities, please see the section on Reports.