Contract Line Item - Contract Terms

Set contract terms on a contract line item. An explanation of all contract types can be found in the Contract Types Editor.

Permissions and Settings

You can view a CLI if:

- You are the engagement manager for the CLI's engagement

- You have the cost center permission View Projects for the CLI's cost center

You can edit a CLI if:

- You have the cost center permission View Projects

- You are the engagement manager. Your allowed changes are determined by the engagement stage settings.

- You have the cost center permission Maintain Projects and Engagements

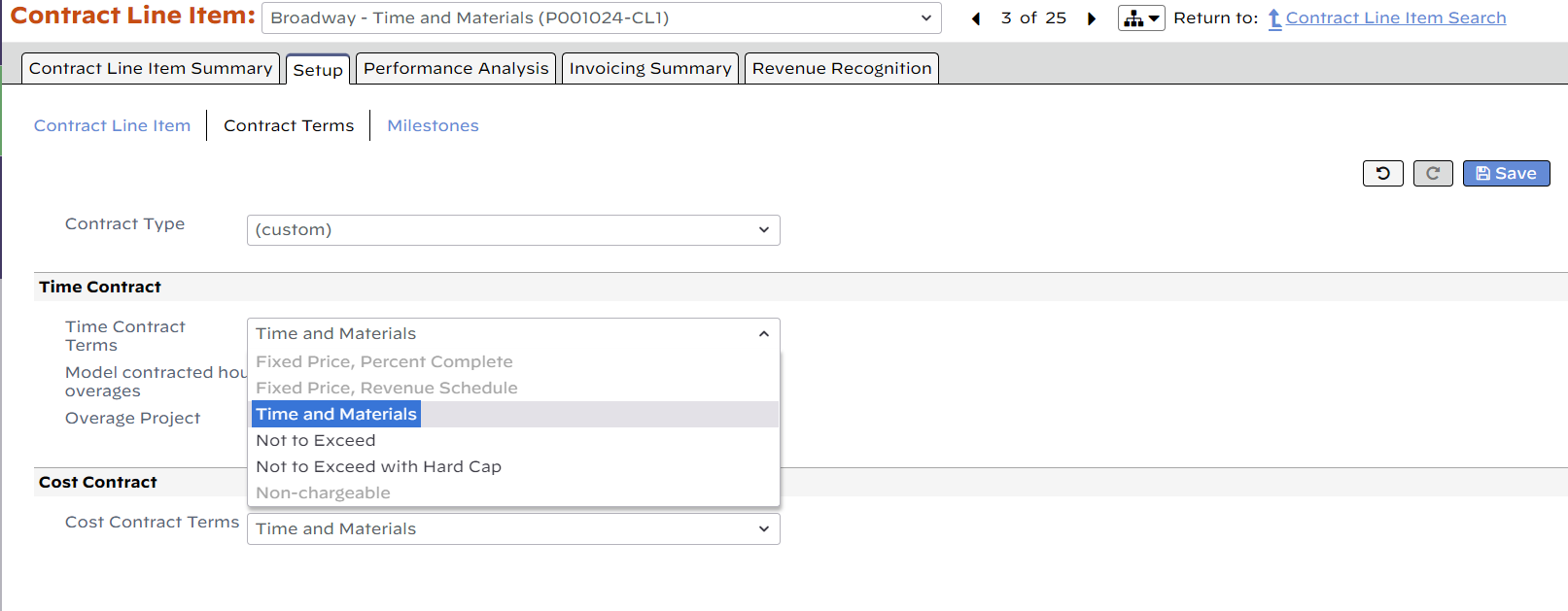

Time Contract

The Contract Terms dropdown list contains four choices, Time & Materials, Not to Exceed, Not to Exceed Hard Cap, and Fixed Price. Each is explained below. These four choices each have an effect on how revenue recognition is done on the engagement. In the sections below a short description of how revenue recognition occurs is described. You should visit our Revenue Recognition how-to for more information on when, why, and how revenue recognition is done.

Once a time card has been approved you cannot change the contract terms between T&M/NTE to Fixed Price or vice versa. This is because the accounting methodologies for the contract types are incompatible. If you incorrectly setup a project then there are a couple ways to fix the problem.

- Create a new contract with the correct terms and transfer the time to it

- Unapprove the time cards, change the contract terms, and reapprove the time cards

Time (& Materials)

Although this contract type is referred to as "Time & Materials", it only encompasses time, not materials. The misnomer is due to the standard vocabulary of the PSA market. Choose T&M if you wish to charge the client for all reported hours and do not have a specified contract amount. There are no limits to this contract term, and Projector will allow you to bill as much or as little to the client as you would like.

Revenue is recognized as the work is done based on the billing adjusted revenue. Typically on a T&M engagement you always allow Projector to calculate how much revenue is recognized and when it is recognized. You can override the automatic recognition, typically for generating a reserve. For example, despite earning 10k of revenue in a month, you dial it back to 9k. See the Revenue Recognition section referenced at the top of this section for more information.

Milestones on T&M engagements are used to model prepayments. This generates deferred revenue which is then consumed by time as it is approved. See the milestones section for more information.

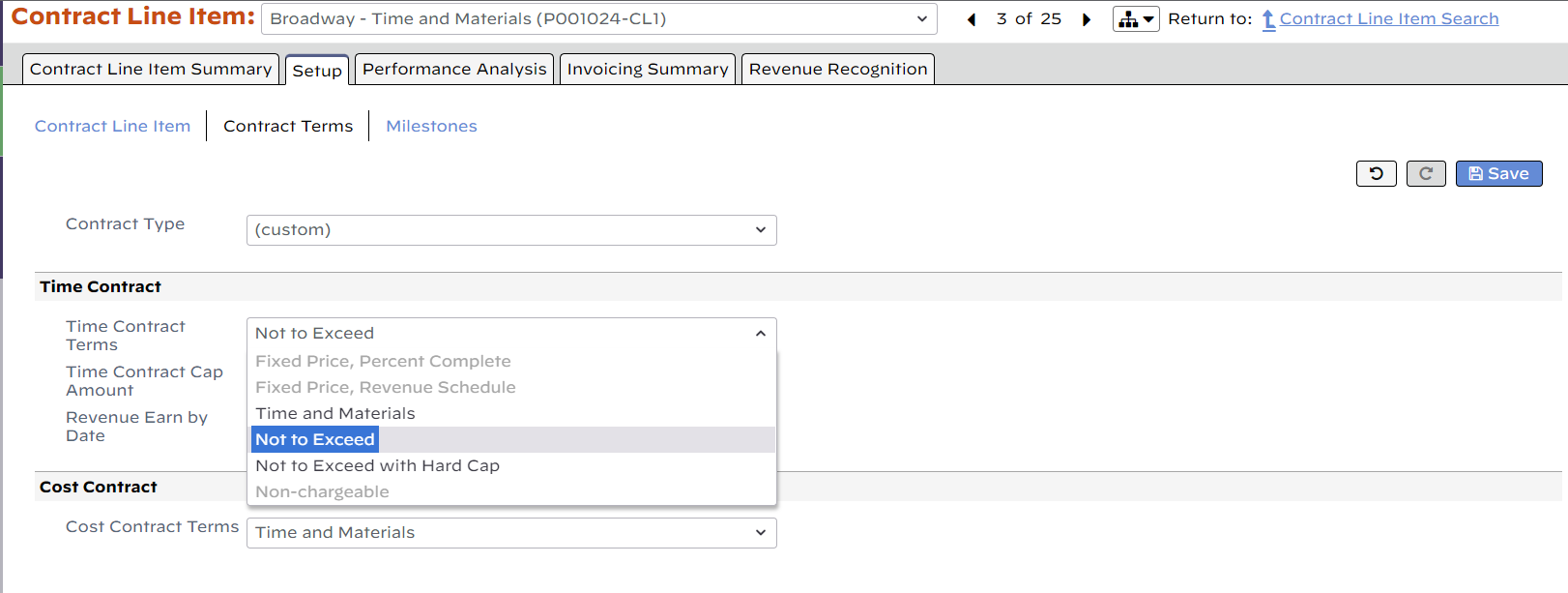

Not to Exceed

Choose NTE when the client will only pay up to a certain limit. Once the cap is reached, Projector will no longer allow you to issue invoices for more than the cap amount.

Just like in a T&M engagement, revenue is recognized on time cards as they are approved. However, when the cap is reached Projector changes to behave like Fixed Price. That means revenue is distributed across time cards using dynamic system revenue allocation. If you hit your cap and raise it, then historical time cards will adjust to fit within the new cap. In addition, you can switch to T&M and lift the cap entirely. The only case where system revenue on historical cards would not be affected, is if you have run revenue recognition on the engagement.

NTE engagements also have a field called Revenue will be earned by. This date field represents when you would expect to earn revenue on an NTE engagement. As of today, this field does not come into play, but may be used as part of future enhancements to our contract management features.

Revenue Recognition may optionally be performed on NTE engagements. Use cases are for good hygiene at larger organizations, when you foresee the cap being exceeded, or when you want to spread the revenue over the life of the engagement.

Milestones on NTE engagements are used to model prepayments. This generates deferred revenue which is then consumed by time as it is approved. See the milestones section for more information.

Not to Exceed Hard Cap

Choose NTEHC when the client will only pay up to a certain limit and you need a hard flag for your users. This contract type operates exactly the same as NTE, however, we will not allow you to approve time cards until they are either conform to the cap or the cap is raised. This is a useful control if you want to force a project manager's hand to actively adjust projects as delivery thresholds are hit.

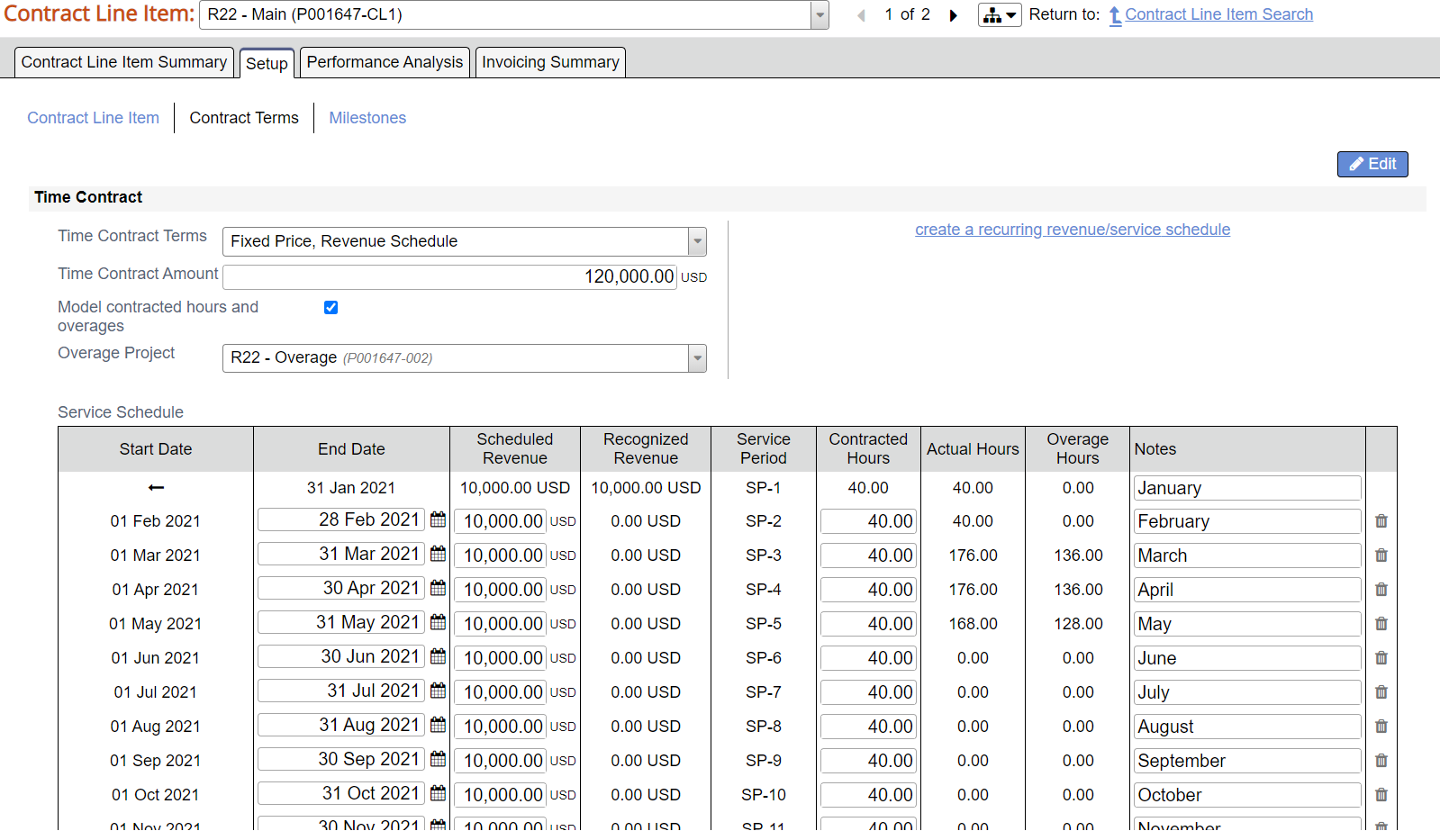

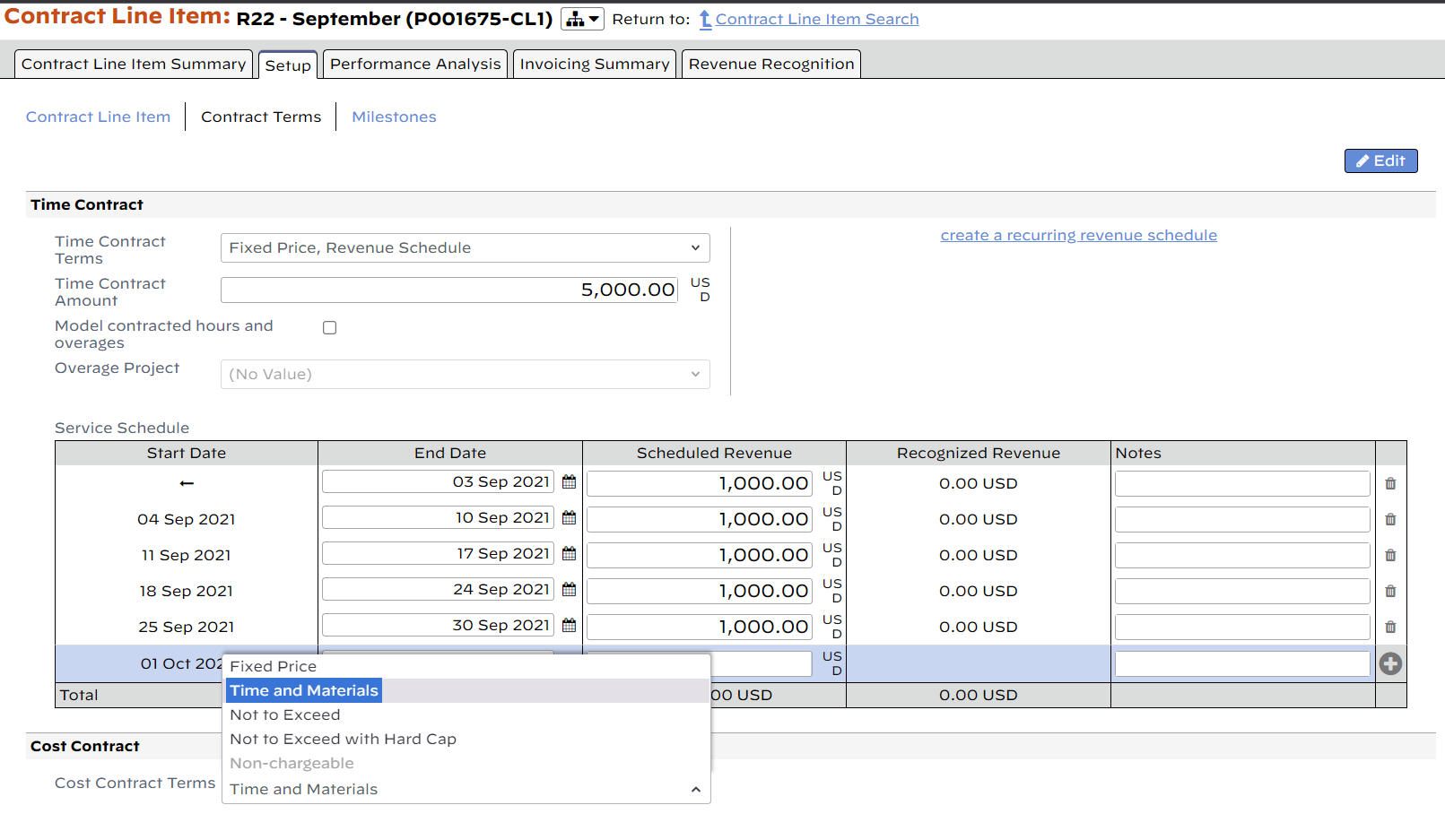

Fixed Price

Choose FP when the client pays a fixed amount regardless of the amount of work required to complete the contract.

Revenue is recognized based on the Revenue Recognition Method you choose from the dropdown list. The Percent Complete method allocates revenue depending on the installation setting Base Percent Complete On. This can be one of three methods, Person Hours, Resource Direct Cost, or Contract Revenue. A Revenue Schedule allows you specify date ranges within which a certain amount of revenue will be recognized. Revenue allocations can also be manually specified using a process called Revenue Recognition. Please see the Revenue Recognition section below for more information.

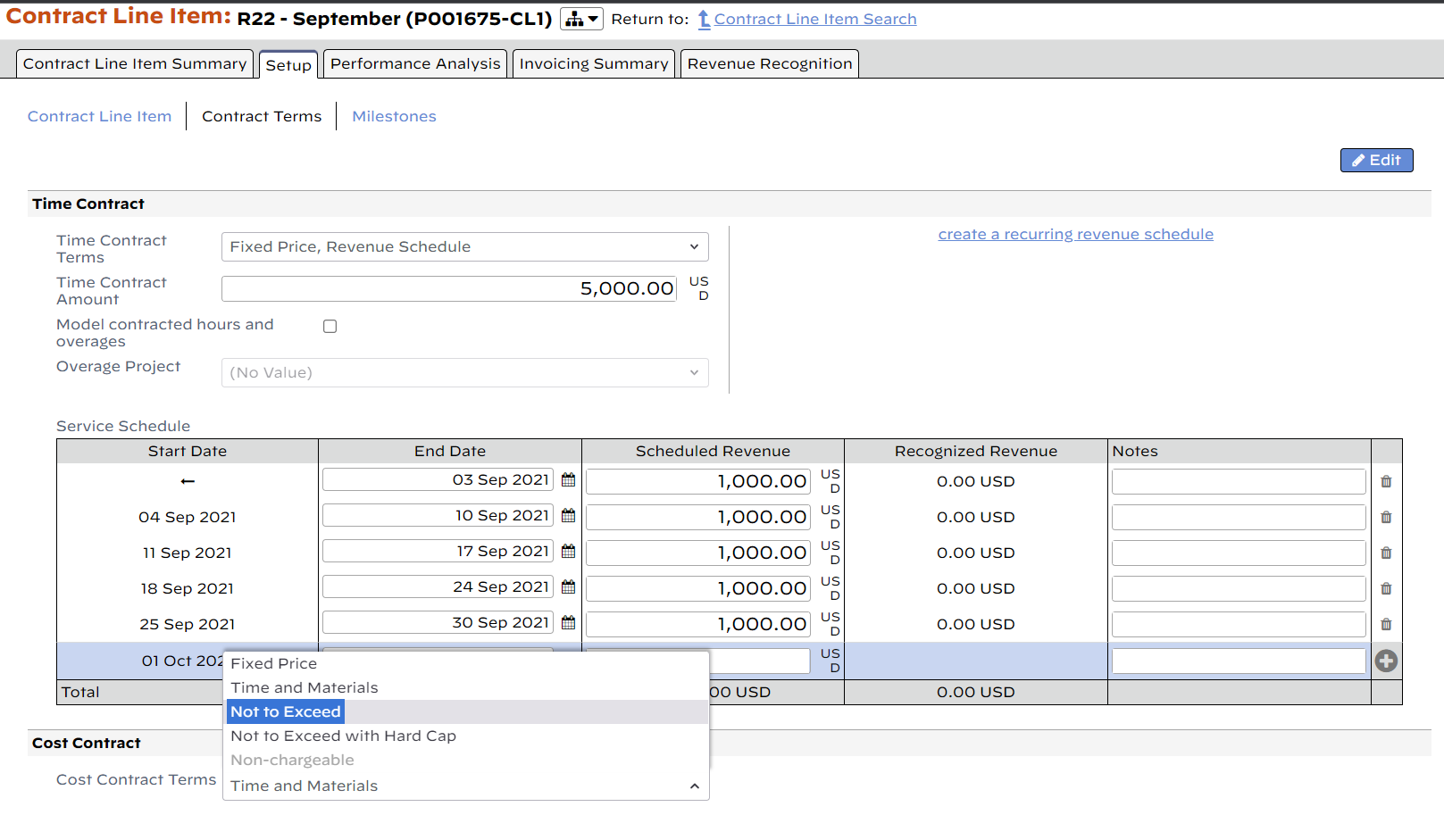

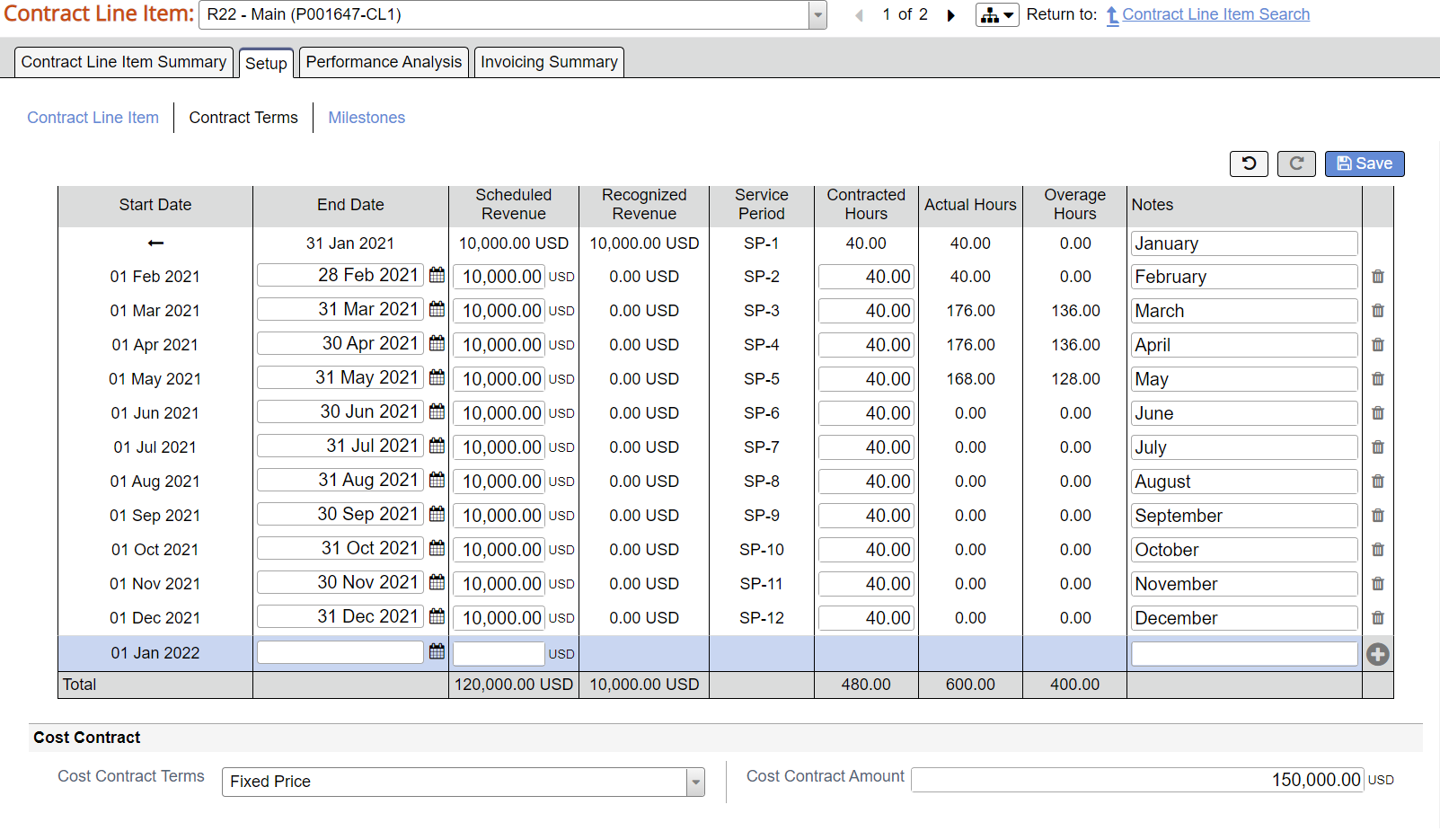

Service Periods

The Service Periods grid is shown for contracts with:

- Revenue Schedule

- Model Overages ticked

When there is a revenue schedule, the service period grid determines how much revenue will be earned in a particular date range.

When model overages is ticked, the service periods determine how many hours are contracted for a particular date range.

| Column | Description |

|---|---|

| Start Date | Beginning of the service period. If it contains an arrow, <–. that means all preceding time |

| End Date | End of service period (inclusive) |

| Scheduled Revenue | Amount of revenue to be earned between the start and end date |

| Recognized Revenue | Amount of revenue that has already been recognized for this service period |

| Service Period | The name of the service period |

| Contracted Hours | If overages is ticked, enter the number of hours that have been agreed to |

| Actual Hours | Approved hours as of right now |

| Overage Hours | Approved hours that have exceeded the contracted hours. These hours are awaiting transfer to an overage project. |

| Notes | Free form text field to enter notes about the service period |

| Delete | Delete the service period. You cannot delete a service period if revenue recognition has already been done on it. You'll need to first reverse revenue recognition. |

Cost Contract

The Cost Contract Terms dropdown list contains three choices, Time & Materials, Not to Exceed, and Fixed Price. Each is explained below.

Time And Materials

Although this contract type is referred to as "Time & Materials", it only encompasses materials, not time. The misnomer is due to the standard vocabulary of the PSA market. Choose T&M if you wish to charge the client for all reported expenses and do not have a specified contract amount.

Not to Exceed

Choose NTE when the client will only pay up to a certain limit. Once the cap is reached, Projector will no longer allow you to issue invoices for more than the cap amount.

If you have an engagement where both time and cost are covered by a single amount, then we recommend setting the cost side of the equation to NTE with a contract value of zero. Then roll the cost contract amount into the time side of the equation. For most services organizations this isn't a big deal because the time contract value often dwarfs the cost contract value. The benefit of this approach is that when you create invoices, cost cards will be swept onto the invoice, but you'll be reminded to write them down to zero prior to issue. If you use this approach you may also want to enable the setting to hide zero dollar cost cards from invoices.

What if you have an FP cost contract for a non-zero amount, or don't want to roll it into the time side of the equation? In this case you can also do NTE at $X. However, you'll need to be aware that if you come in under the cap, then you need to write time cards up to reach it. You will get no warning on this. So potentially you could short yourself money. You are still covered in cases where you exceed the cap though, you'll be reminded to write down cards to conform with the contract terms.

Fixed Price

Choose FP when the client pays a fixed amount regardless of the amount of work required to complete the contract. Most installation's won't use this choice. A preferred method is an NTE contract type. If you choose to move forward with a FP contract, you'll need to learn a special process for running revenue recognition. You should already be familiar with time revenue recognition. With that method, you issue milestones which generates a deferred revenue balance. You then consume that deferred revenue by running revenue recognition. In FP expense contracts, there is no revenue recognition process. Rather you follow these steps:

- Invoice a milestone for the FP expense contract amount (or portion thereof)

- Create a blank invoice for the client

- Pull the FP cost cards onto the invoice. If you'll recall this is blocked for time cards, cost cards operate in a special way for this exact case. They can be pulled onto the invoice.

- Write up/down the cost cards to equal the milestone amount

- On the invoice tab, you'll see a deferred revenue balance. Consume the cost card amount with that balance.

- Issue the invoice, but don't send it to the client.

As you can see, the above scenario contains quite a few steps. This is why we recommend running NTE costs where possible.