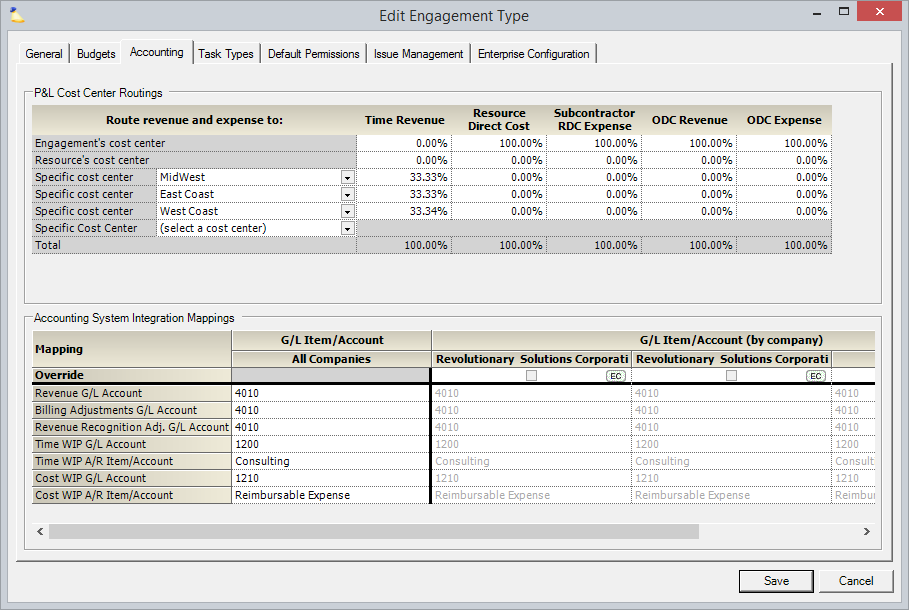

Engagement Type - Accounting Tab

Use this tab to map accounting transactions. If Projector is used as the job accounting system and data is fed into the organization's General Ledger or other sub-ledgers (such as Accounts Receivable and Accounts Payable), these fields (along with fields in the Add/Edit Company, Add/Edit Expense Type, and Edit Cost Center forms) are used to map transactions and balances to the proper cost centers and accounts. Transactions associated with time and expenses can be routed to different accounts if necessary, or can be mapped to the same accounts by entering the same account IDs in the proper fields.

This tab is also used to split revenue amongst cost centers.

Permissions and Settings

To edit Engagement Types you need the global permission Maintain System Settings set to update.

The P&L routing section values are the default for new engagements. However, they can be overridden on a per project basis from the Project Advanced Setup Tab. If you need to analyze split revenue in our reporting engine, look for the "P&L Cost Center" row fields.

The account mapping section is disabled unless the engagement is marked billable on the general tab. Reason being, non-billable engagements do not have any revenue, adjustments, WIP, etc.

Mappings are applied when time is approved, time is transferred, cost is approved, cost is transferred, and when subcontractor invoices are created.

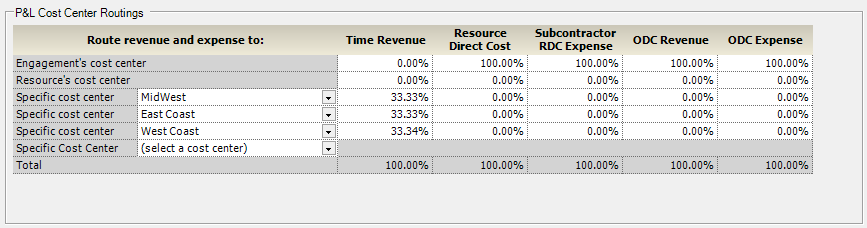

P&L Cost Center Routings

If you are a smaller organization structured into cost centers that own both the engagement and resource, you'll likely want to allocate 100% of the P&L to the engagement and stop there. If your resources and engagements are held in different cost centers, then choose the cost center where you calculate your profit and loss.

Larger organizations that have a complicated cost center structure with multiple teams will want to think hard about how they want to model P&L splitting. Splits allow you to accurately model any cost centers that influence delivery of billable work. It also can be used to encourage resource sharing between different divisions. Here are a few practical examples.

- Delivery influencers - you may have divisions that contribute to earned revenue which you would like to reward with a slice of revenue. For example, your sales team does not generate any directly billable work, but you would still like to reward them with a portion of any billable time. Or you have a software product that is resold as part of your delivery process. You award some of that odc revenue to the developers who wrote the software.

- Resource Sharing - if you are an organization that has several divisions, you may find that some divisions don't want to share resources with other divisions. Reason being, their performance is measured based on the P&L. If I loan you my resource, I incur all the loss of paying that resource, but get none of the revenue to boost my profit. By splitting revenue out to a separate cost center, you reward divisions for collaborating.

All percentages must add up to exactly 100.00% for each column.

| Column | Description |

|---|---|

| Cost Center | Choose from:

|

| Time Revenue | Revenue earned from time cards |

| Resource Direct Cost | Due to paying resources |

| Subcontractor RDC Expense | Due to paying subcontractors |

| ODC Revenue | Profit earned from marked up expenses |

| ODC Expense | Loss due to company born expenses |

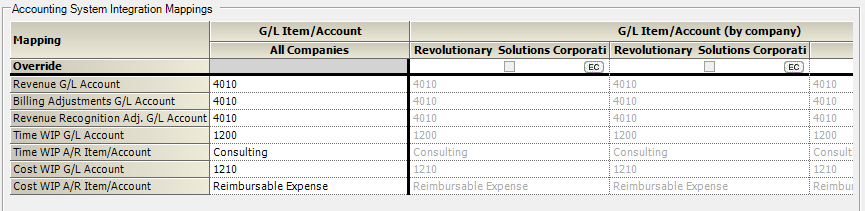

Accounting System Integration Mappings

The following table gives a short description of each account mapping. WIP stands for Work in Progress. It represents revenue you have earned and that you expect your client to reimburse you for.

Account | Description |

|---|---|

Revenue G/L Account | Revenue generated by billable time |

Billing Adjustments G/L Account | Write ups/downs of time cards, revalue |

Revenue Recognition Adj. G/L Account | Revenue recognition adjustments are created when actual and projected contract revenues don't match |

Time WIP G/L Account | The value of approved time that has not yet been invoiced. |

Time WIP A/R Item/Account | Route revenue out of WIP when it is invoiced.

|

| Cost WIP G/L Account | When an expense is approved, if there is a markup, then the amount of that markup |

| Cost WIP A/R Item/Account | Route revenue out of WIP when it is invoiced.

|

Default Mappings

If you encounter an accounting synchronization error for one of the below account names, then it is most likely you have forgotten, or not yet had to, set up account mappings for this engagement type.

Account | Default Time Mapping |

|---|---|

Revenue G/L Account | Revenue (T) |

Billing Adjustments G/L Account | Bill Adj Revenue (T) |

Revenue Recognition Adj. G/L Account | Rev Rec (T) |

Time WIP Progress G/L Account | WIP (T) |

Time WIP Progress A/R Item/Account | WIP (T) Item |

| Cost WIP Progress G/L Account | WIP (C) |

| Cost WIP Progress A/R Item/Account | WIP (C) Item |

To correct the mapping:

- Find the engagement responsible for the error

- Edit the engagement and note the type

- Go to Administration Tab | Job Accounting | Engagement Types

- Edit the noted type

- Go to the Accounting Tab and set the appropriate account mappings

- Reapply mappings to the transaction

- Resync with your accounting package

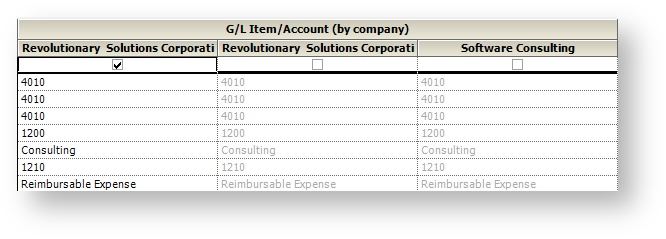

Enterprise Configuration

If you have multiple companies defined in your installation and you have Enterprise Configuration enabled, then you will have the option to map separate charts of accounts for each company. Tick the checkbox for each company that has its own set of mappings. Then fill in the grid.