VAT for Multiple Receivable Accounts

In a few countries there are multiple VATs. Notably this occurs in Canada where you might have GST and QST. Projector only supports a single VAT Receivable account. This document explains an approach to handle multiple VATs using this single account.

VAT Recap - you enter VAT on expenses and collect VAT on invoices. Learn more at these links:

Example

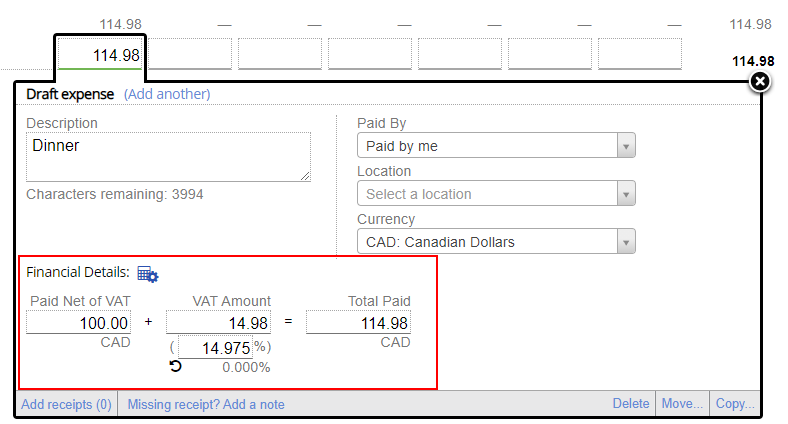

Let's use an example $100 expense in Quebec. You need to apply 5% GST and 9.975% QST. In the screenshot below of expense entry notice that there is only a single VAT Amount field rather than two.

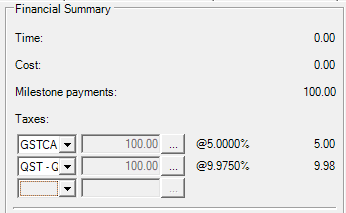

When you go to invoice the expense we CAN have separate GST and QST taxes.

Have more than three VATs? It happens rarely, but sometimes you have 4 or more VATS. In that case you would need to combine two of them into a single tax type on the invoicing side.

VAT Payable Account

VAT Receivable Account

When you approve an expense

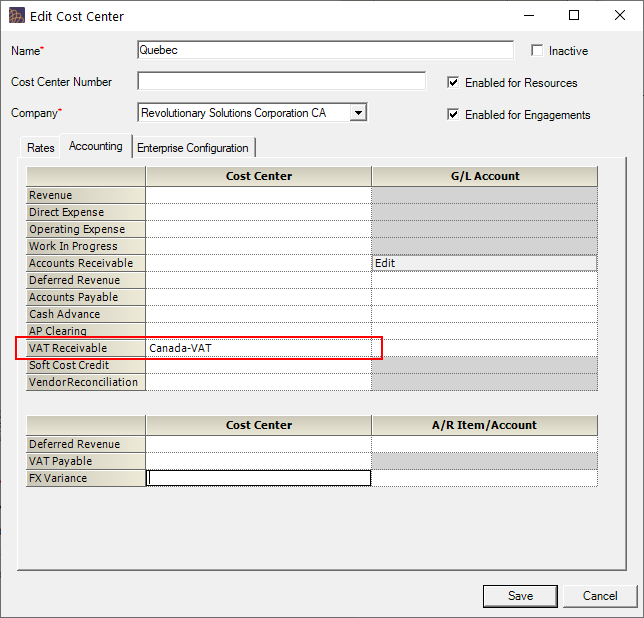

Each expense document and invoice is associated with a cost center. On the accounting section of that cost center is your VAT Receivable account.

Setup VAT for Expense Entry

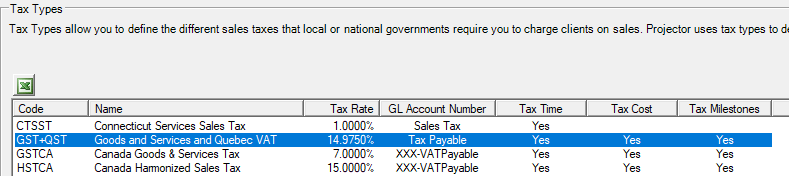

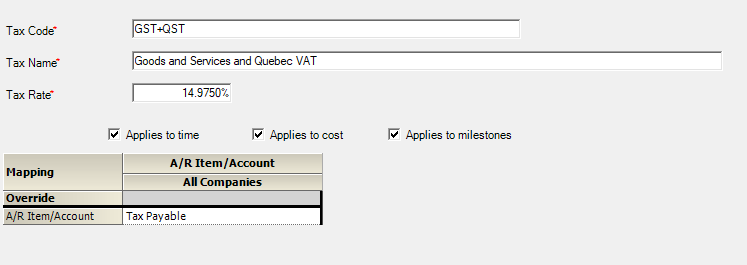

- Add a combined tax type called GST+QST at a rate of 14.975%. This is used for invoicing.

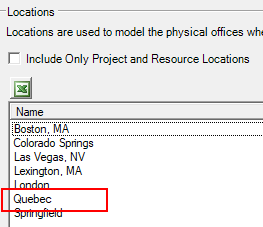

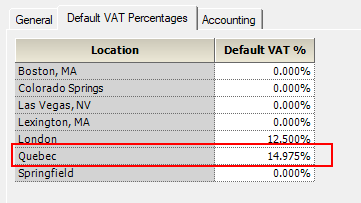

- Add a location where VAT is collected. This is used for expense entry.

- Edit each expense type and on the VAT Percentages tab set the default VAT %. for your location.

- Now when you enter expenses in that location you'll be prompted to provide the total VAT amount.

Accounting Transactions

On approval of an expense we'll generate a GL transaction for your VAT Receivable account.

On issue of an invoice we'll generate a GL transaction for your Tax Payable account.