Vendor Reconciliation MP

Although we would all like expenses to be incurred, logged, and approved instantly - the reality is that this does not happen often. If your resources are using a company-paid credit card, then you'll likely find yourself in a situation where your credit card vendor sends you a bill, but your expenses have not been approved yet. Projector's vendor reconciliation features allow you to issue payment to the vendor before all expenses have completed the approval process. Vendor reconciliation can also be used to accommodate payments for costs that will never be entered into Projector, such as late payment fees.

Permissions and Settings

You must have the cost center permission Administer Expense Document Payment Workflow for the expense document's cost center to create, modify, or delete payment vouchers.

Further details on Vendor Reconciliation Accounting Transactions can be found in our Projector Accounting Integration document.

Your company credit card vendors are managed through the Vendor Editor.

In Practice

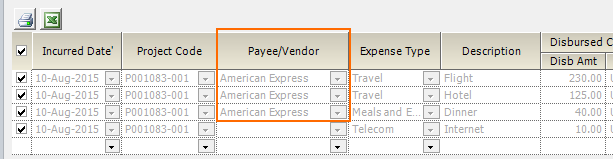

A practical guide to the life-cycle of a reconciliation item. For this example, pretend you received a credit card bill for three expenses. One of those expenses is approved, the other two are still in draft. The screenshot below shows our two draft cards. How do you pay the credit card bill without having to chase down your approvers for the other two expenses? Reconciliation items, that's how!

Read This

If you are glossing over this documentation, don't skip this part. To start using reconciliation items, you need to reset your brain on how you Approve to Pay expenses.

See these credit card paid expenses? Don't Approve to Pay them!!!

Why not? - because you are going to be doing things a different way now. Rather than approving expenses and generating payment vouchers, you are going to make a single payment voucher for your entire credit card statement. Then you are going apply expenses against that single payment voucher until the entire thing has been reconciled.

Rule of thumb - if an individual expense is from a company-paid credit card, don't approve to pay it.

Create Payment Voucher

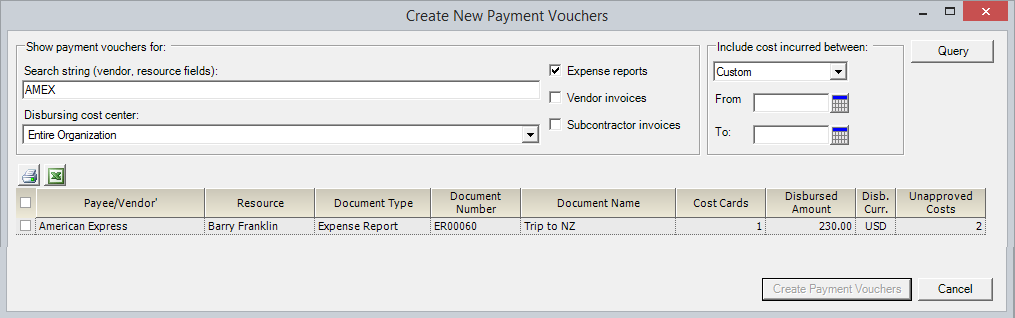

The first thing you need to do when you get your credit card statement is to gather all your existing expenses onto a new payment voucher.

Go to your payment voucher tab in Management Portal. Click Create Payment Voucher. Find all the expenses for your company credit card and create a voucher for them.

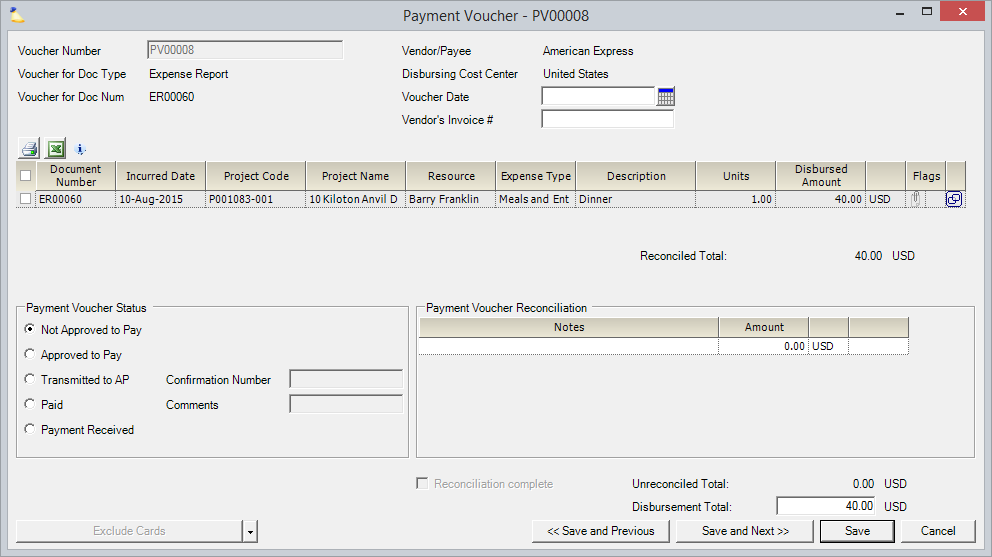

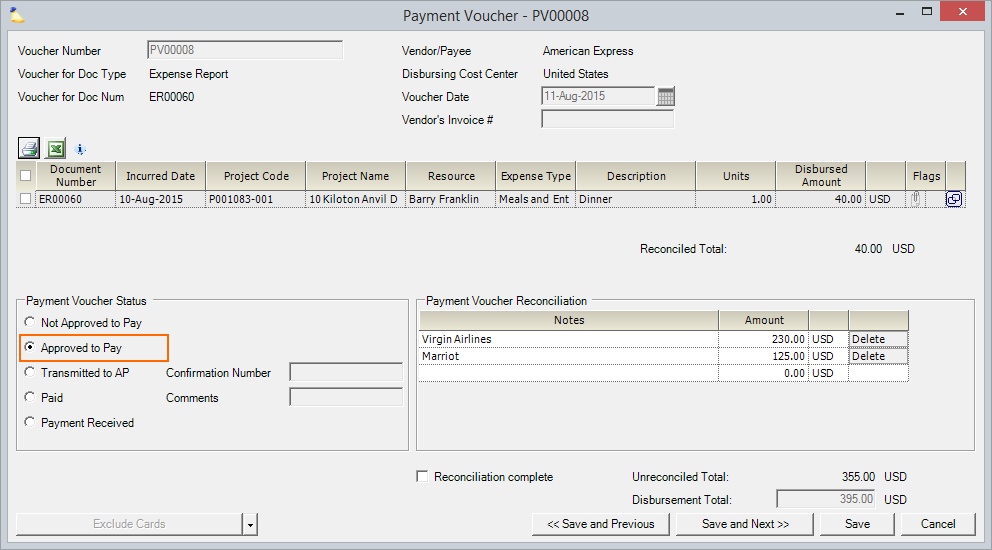

Here we have the payment voucher with one cost card on it.

Create Reconciliation Items

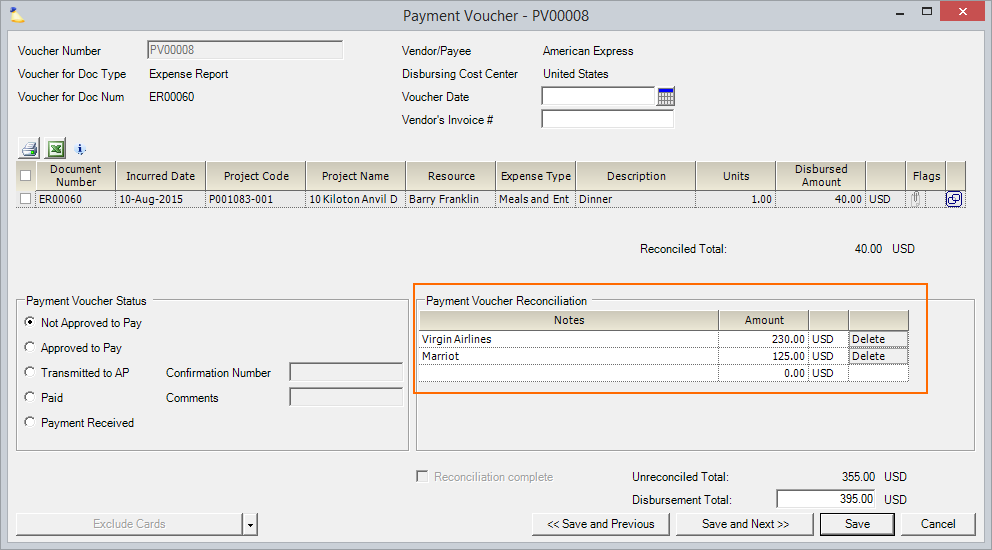

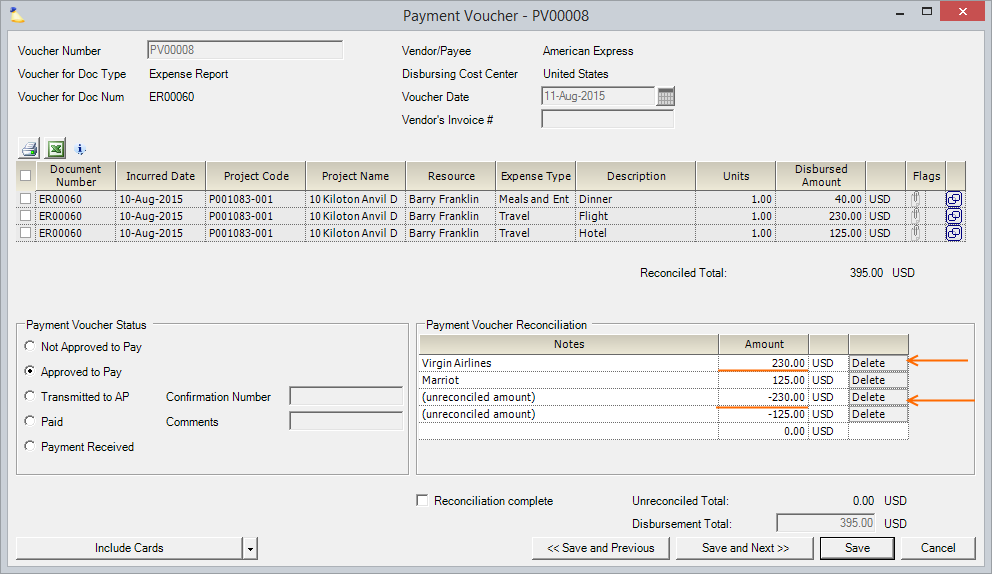

Next we need to account for all the expenses that were not ready for Approve to Pay. We'll be adding reconciliation items for each line item on the credit card bill. In the screenshot below, in the red box, are the reconciliation items I've added.

Pay Vendor

Now that all your reconciliation items are in place, mark the payment voucher Approved to Pay. You can send AMEX their money.

Review Unreconciled Payment Vouchers

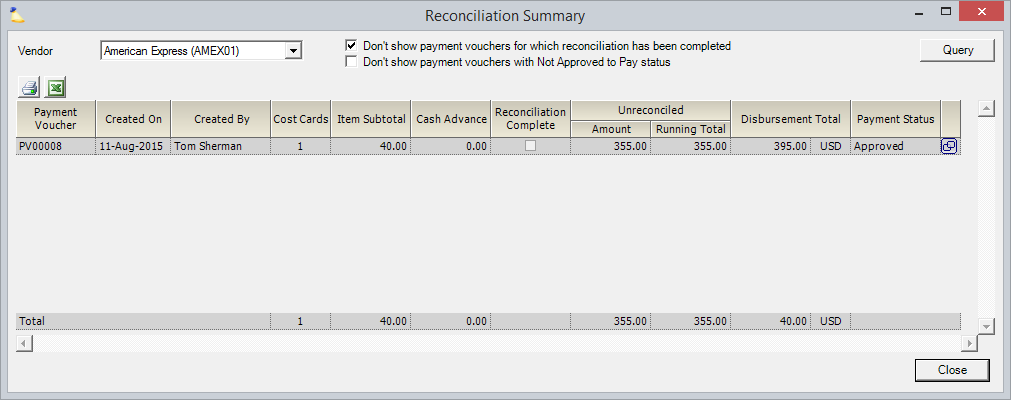

Later on, as your expenses all get into the system, you'll want to review your unreconciled payment vouchers. Choose View Vendor Reconciliation Summary from the multi-select dropdown list.

Reconcile Payment Voucher

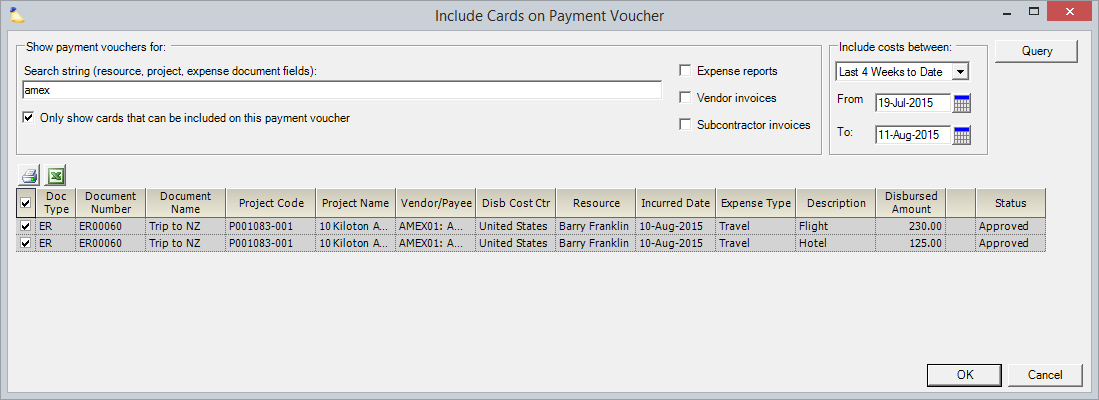

Once all your expenses are in, open your unreconciled payment voucher. Click Include Cards from the multi-select dropdown list.

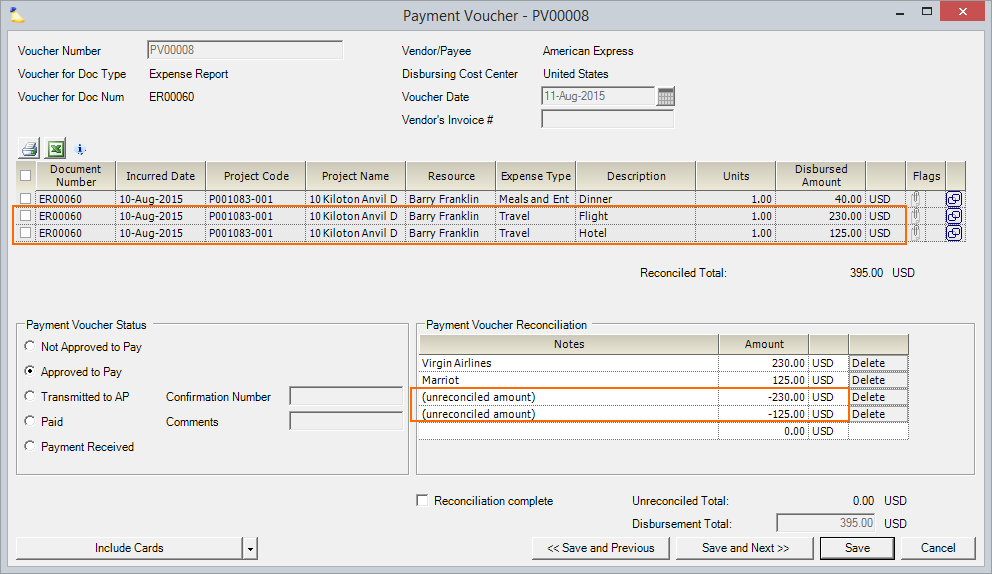

The cards are added to the payment voucher AND a reconciliation item is auto-added for each expense. They have the name "unreconciled amount." See the two orange boxes in screenshot below.

Next, Delete any matching reconciliation items.

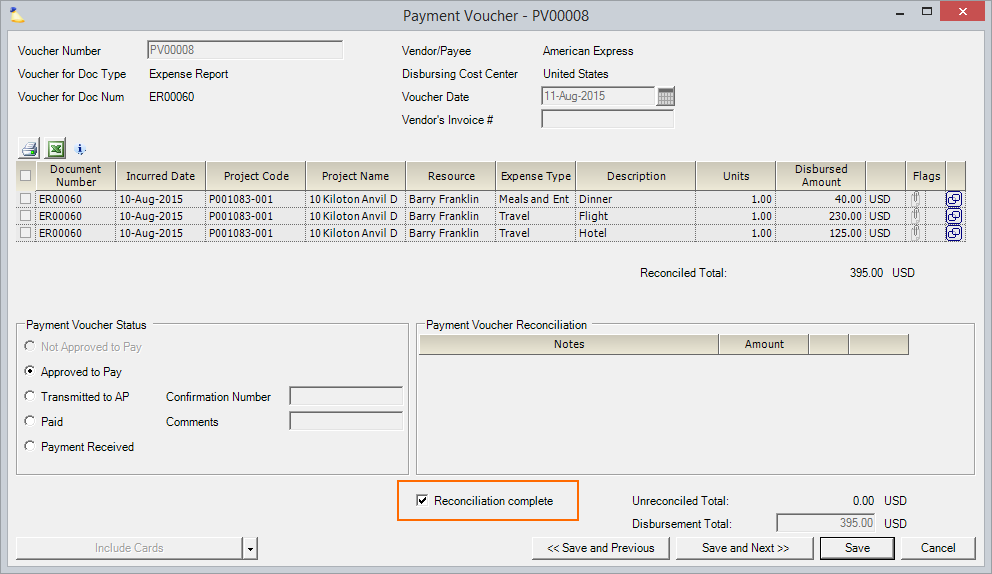

When there are no more reconciliation items, click Reconciliation complete.

Credit Card Fees

If you have a credit card fee that will never have a corresponding payment voucher, then you can leave it as an unreconciled item the payment voucher.

Accounting

For detailed information on the specific accounting transactions related to Vendor Reconciliation please visit the Projector Accounting Integration.